WEB 3.0 : To the Moon or the LUNA way?

If you have been keeping up with the buzz in the tech-crypto world, you cannot miss the next iteration of web internet, the Web 3.0. One can hate the idea of the internet on blockchain or might pip it as the next revolution, but love it or hate it, you simply cannot ignore it.

Before we get into technicalities, if you’re not a crypto geek, you might have a faint understanding of blockchain jargon, so let's revisit a few concepts briefly.

BLOCKCHAIN:

Blockchain is a decentralized, unchangeable database that makes it easier to track assets and record transactions. Since it is immutable, it becomes near impossible to hack or cheat into the data.

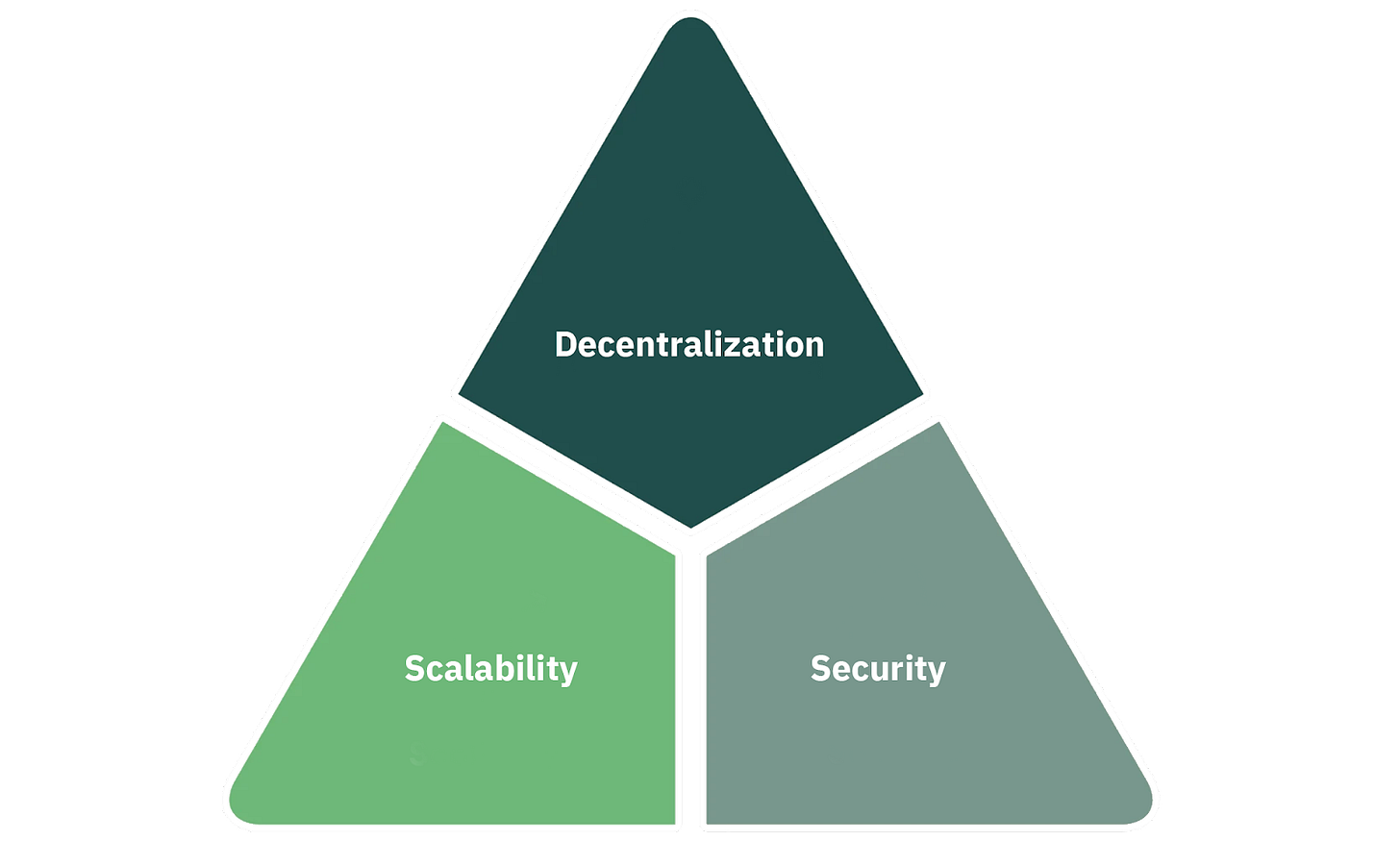

The three main pillars of blockchain are, Security, Decentralization and Scalability. All three factors constantly strive to co-exist but struggle to live in harmony given there are higher security challenges as the technology scales in size. This is referred to as the ‘trilemma’ of the crypto world.

CRYPTOCURRENCY:

A cryptocurrency is a type of digital asset that relies on a network spread across several computers viz.blockchain. They exist independently of governments and other central authority thanks to their decentralized nature.

STABLECOINS:

Stablecoins are cryptocurrencies whose value is pegged to a reserve asset like a currency (such as the dollar or the euro) or a commodity (like gold, oil or real estate). Stablecoins are so named because their value is less susceptible to wild price swings because it is backed by other assets.

VOLCOINS:

Volcoins or Volatile coins are cryptocurrencies whose value could be purely speculative, backed by an assumption of greater stablecoin demand in the future.

The price of the volcoin comes from the expectation of future activity in the system.

SMART CONTRACTS:

Smart contracts work by following simple “if/when…then…” statements that are written into code on a blockchain. These agreements are executed on satisfaction of predetermined conditions so that all participants can be immediately certain of the outcome, without any intermediary’s involvement or time loss.

Now that we have established a few concepts, let's get deep into the TERRA LUNA fiasco.

What is Terra(LUNA)?

To understand Terra( LUNA) we must also understand TerraUSD(UST).

Terra( LUNA) and TerraUSD (UST) was created by Terraform Labs, founded in 2018 and located in Seoul, South Korea.

The idea was to create an ‘algorithmic stablecoin’ where LUNA could be burnt in order to ‘mint’ UST to stabilize it whenever it loses its 1:1 peg to the dollar, and vice versa. For example if UST hit 0.99, a small amount of LUNA would be burnt, and if it hit 1.01, a small amount of UST would be burnt.

What went wrong with Terra(LUNA)?

There are various theories and various explanations by different crypto gurus, but economically speaking, it was a classic case of demand-supply blunder.

See, when UST, which is the stablecoin is pegged to the USD 1:1, was dumped in the market, the supply of the stablecoin increased and consequently the price slipped below 1 USD( this is called depegging).

Whenever supply is increased without complimenting demand, prices tend to go down.

As the liquidity of stablecoin increased in the market, without similar levels of demand, the prices tumbled down.

Who caused the dump in the market?

Honestly, nobody knows for sure, given how anonymous things are on the blockchain, it's nearly impossible to pin down on a specific person or institution. As per a few, it might be an attempt to tarnish the image of Terra.

How does the falling price of UST affect LUNA?

Since LUNA derived its value from UST based on greater demand of UST in future (much like how derivatives derive their value from an underlying asset), it started falling as the ‘stablecoin’ was simply no longer stable.

Why was UST’s demand expected to grow in the future?

Simply because UST-LUNA promised to solve the biggest problem of cryptos; their volatility.

With a stablecoin- volatile coin combo it offered speculation (higher risk, higher return) based on a stable asset pegged to the USD.

Attempts to revive the LUNA coin

Luna Foundation Guard (LFG) was created to build a bitcoin collateral backstop for the UST stablecoin. As UST began to lose its peg, the LFG’s BTC started to move. It tried to reconcile from this debacle by selling off its Bitcoin reserve worth billions to buy LUNA in the hopes of propping up the prices of LUNA , but it was simply not enough.

Again, unsurprisingly due increased supply of Bitcoin in the market, its value took a nosedive.

With Luna losing its 99% of value within a few days, the vulnerability of the market was exposed.

Takeaways from the Luna crash

The crash was caused by a sudden pump of UST in the market. Few theories say they were dumped by big institutions while some say it was a personal attack on Do Kwon, CEO , Terraform Labs.

LGF simply did not have enough assets in reserve to stabilize the depegged UST.

Terra’s brand value took a huge hit, the CEO’s arrogant image only made it worse.

Will Web 3.0 take the luna way?

Short answer: NO

Long answer:

There is no direct comparison between Luna and Web 3.0, Luna/UST are cryptocurrencies whereas Web 3.0 is internet on blockchain.

It's like comparing UPI with INR, the former one an interface, a platform for settling payments , whereas the latter one is a currency which is prone to ups and downs.

Another comparison could be web 2.0 and Facebook , while one is a network, the other one is a company which has tradability and hence susceptible to market sentiment and conditions.

Sure technologies wear out but they are nowhere near as volatile as a currency or a tradable commodity.

It takes years if not decades for a structural change in technology.

Web 3.0 sure comes with its own set of problems but the opportunities and possibilities if offers outweigh the risks.

While implementation of Web 3.0 might differ with the way we imagine today, we will definitely see versions of it being used, especially in the field of finance.

Is Web 3.0 the future?

Yes, but to expect a complete decentralized version of it might be a far fetched idea.

Governments around the world may not allow a completely transparent system given how such systems can be used for illegal and immoral activities and let's be real no superpower countries would happily want to share data with other countries due to innumerable reasons.

But elements of it will surely be incorporated in the current system allowing greater sense of freedom and tranparentibilty.

.