Hello once again!

Thanks for opening this week’s newsletter.

Today we are going to talk about a fictional character from the famous TV show, The Office.

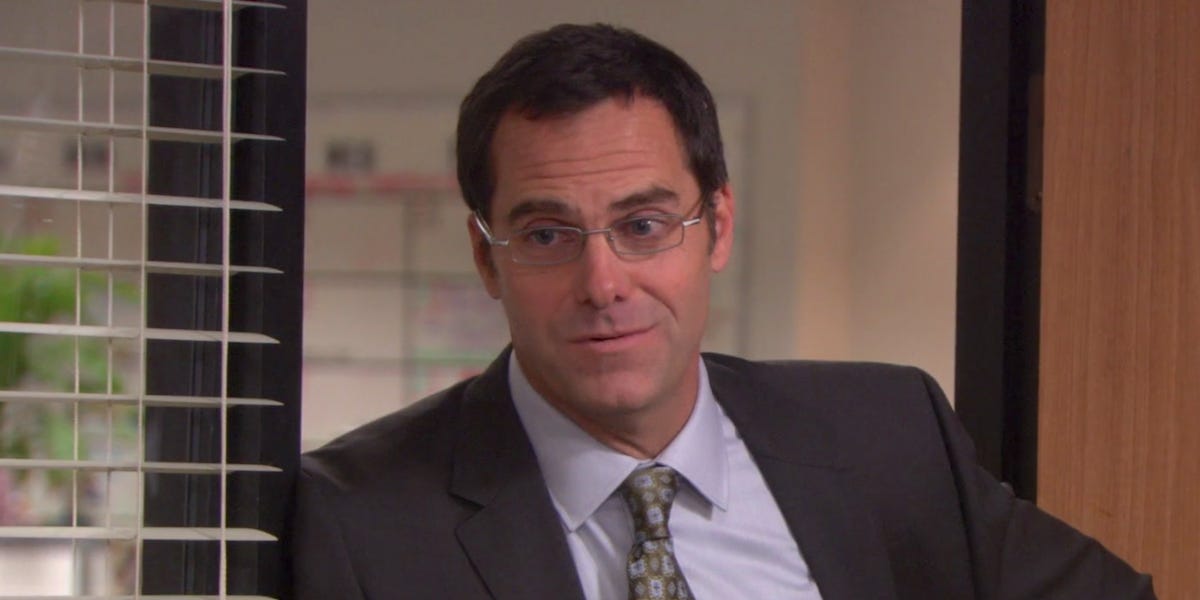

We take a fresh approach to discuss David Wallace, the ex-CFO at Dunder Mifflin, a midsize paper company in Scranton. We will take a deep dive into some of his decisions as a CFO. We will talk about the following:

The Good Parts

The Bad Parts

His role as the boss

It's time for a reminder that David Wallace, CFO (later CEO) of The Dunder Mifflin Paper Company, was not always a great CEO.

As a fan of The Office, you may remember David Wallace.

Wallace was the CFO and later CEO of Dunder Mifflin during its struggle to survive against rival companies such as Staples and Cartman's Paper Company.

He had mixed success as CFO and CEO and there are mixed opinions about his tenure as the CFO and a lot of criticism of the decisions he made on Reddit and Twitter.

This newsletter will go through the good and bad decisions made by Wallace as the boss and CFO while illustrating the basic role that the CFO plays in a midsize paper company.

We want to help you get a better understanding of what he did right and wrong so that you can learn from it when you take on a new role in your own company.

The Good

In his time as CFO of Dunder Mifflin, David Wallace was in charge of sales, revenue, and budgeting.

“David Wallace, CFO of Dunder Mifflin, employed the most sense and executive capacity in the show.”

Source: https://medium.com/@wendynolin/3-practices-to-ease-difficult-conversations-33c7e1fc14ae

He may have made some bad decisions, but he was one of the only sane and level-headed characters at most times—even though he worked for a struggling company in New York City and had to overlook the eccentric, Michael Scott.

Even though he was the CFO of a company that was struggling to keep its head above water, it didn't stop him from making time to go down to Scranton to see how things were going to the Scranton branch office, the only profitable branch in a dying and saturated market.

Even when he became CEO, he made sure that all branches were being run efficiently by keeping tabs on regional managers and interviewing all employees regularly. This helped him greatly when it came time to make promotion and internal transfer decisions.

The Bad

There are a lot of questionable things (see reddit post below), Wallace did during his tenure at Dunder Mifflin, even though he genuinely had the best interest in mind regarding the company and employees.

The biggest proof is how Dunder Mifflin was consistently performing poorly since he joined, whether it was because Dunder Mifflin wouldn't change with the times, or because of the economic conditions, the company was truly in ruins by the time Sabre acquired them.

Looking at the list, you may be getting confused, a lot of his decisions don’t align with what a CFO is supposed to do.

His role as the boss

I think this post explains it fairly well, why there was so much overlap and why it seemed as though he was handling the human asset of the company. But this happens as the needs of each company differ, especially at smaller firms, roles aren’t always well defined.

CFOs are supposed to be leaders overlooking the financial performance of the company, with so many people working under you, many times leadership and people related skills will come in handy, to deal with people efficiently.

You can read more about David Wallace, here.

Did Wallace inspire you to be a part of the c-suite? Keep reading to learn how Sparklehood can help you!

Are you ready to be a CFO?

The CFO is one of the most critical actors in running a business.

They must be able to manage business finances, identify and implement cost-effective solutions, and develop a strategy to maximize profits.

CFOs must also be strong managers with the ability to motivate employees.

Create and implement effective strategies

Communicate effectively with all levels of management within an organization

Make decisions based on evidence and data.

Not quite there yet? Sparklehood can help you!

When you're looking at a new leadership role, it's important to remember that you need two things: a mentor and a supportive network.

Learn from CFOs who have been there and done that! Get curated resources and new opportunities just for you!

A curated community of current and future CFOs to help and guide you.

Join the CFO Open Community now!

Or check out our website for more info - https://cfo.sparklehood.com/